It has been a rather volatile week. We were partly correct in expecting strong impact from politics on the markets. But the reactions to central bank news and economic data surprised us. Dollar was clearly weighed down by FOMC minutes and CPI miss and ended as the weakest one. Meanwhile, Euro reversed early gains and ended mixed on rumors about ECB's tapering plan. There were practical no impacts from US President Donald Trump, North Korea and not even Catalonia. Markets also ignored UK Prime Minister Theresa May. Nonetheless, politics did play a role in the extraordinary volatile in Sterling, which ended as the strongest one.

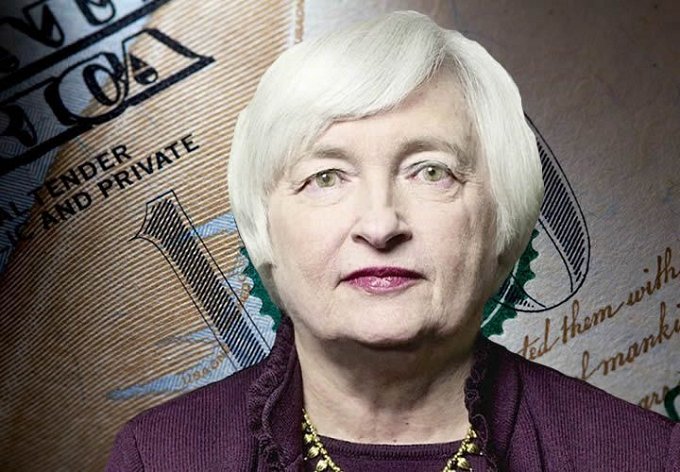

Looking ahead, we will get key economic data and releases from Australia, the UK, and US with some Fed reactions to be look at but the major highlight of this week will be the speech of Yellen that is due on Friday which will give a future outlook for Interest Rates for this quarter.