Daily Update - 14th November 2019

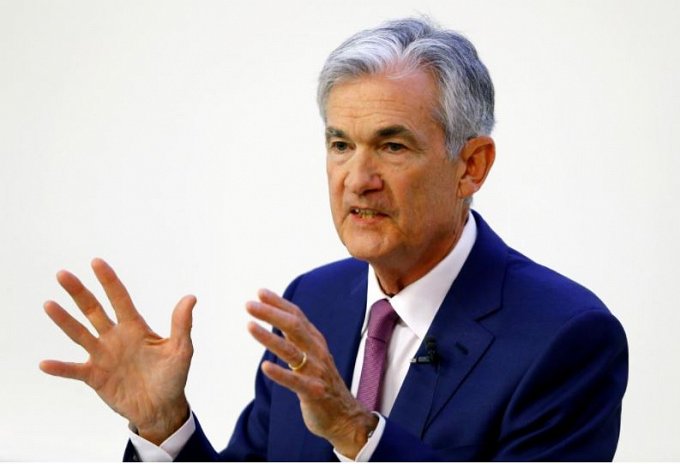

RBNZ has surprised the market by leaving the cash rate on hold at 1%. RBNZ gave no explicit signal of cuts to come, although it does remain open to the possibility of cuts if required. The OCR track was the same as August, troughing at 0.9%. This implies a 50/50 chance of an OCR cut at some point. Similarly, the RBNZ said “We will add further monetary stimulus if needed.” The decision not to cut the OCR was a big surprise to financial markets, as financial market pricing indicated an 80% chance of a cut and most economists were forecasting a cut.” “The RBNZ appears to be pausing to assess how the stimulus delivered to date will affect the economy. The RBNZ acknowledged that the economy is currently weak, but they also acknowledged that commodity prices have been robust, the exchange rate is low, and low interest rates will support spending and investment going forward. The RBNZ did not pay great heed to the drop in inflation expectations in yesterday’s survey, perhaps because market-based measures of inflation expectations have risen.” The US consumer price index (CPI) climbed by 0.4% in October, a stronger pace than the 0.3% expected generally by the market. However, CPI is only climbing at a 1.8% annual rate, below the Federal Reserve target of 2%, and well below last year's peak annual rate of 3%. Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy's health. German gross domestic product (GDP) is expected to show the economy contracted 0.1% quarter-on-quarter in June to September (Q3) period, having decreased by 0.1% in the first quarter. The annualized GDP is forecasted to print at +0.5% in Q3 vs. the previous quarter's reading of +0.4%. Jerome Powell will continue his second day of testimony before congress, alongside some important PPI and jobless claims data in the US. Yesterday’s Market

Yesterday’s explained

Today’s Market

Today’s Focus