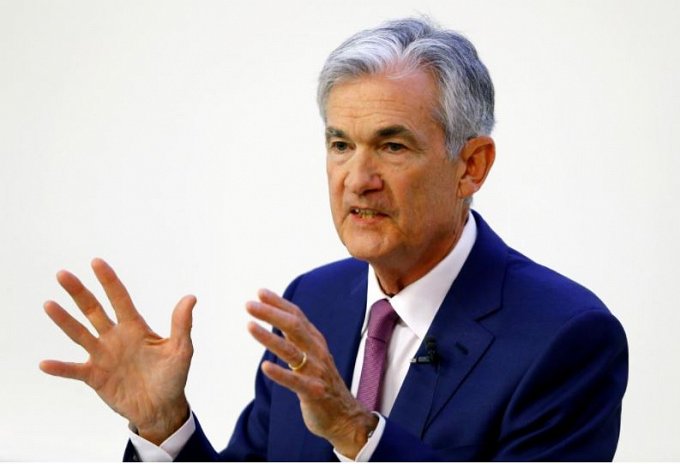

The dollar fell against the yen earlier today as receding hopes for a preliminary trade deal between the United States and China hurt demand for the greenback. The yuan touched a two-week low versus the greenback amid doubts about the U.S.-China trade war. There have been high expectations that the United States and China would sign a so-called “phase one” deal this month to scale back their 16-month long trade war. But the dollar took a hit on Monday after CNBC reported that China is pessimistic about agreeing to a deal, which suggests a resolution to perhaps the biggest risk to the global economy remains elusive. Currency traders were also wary of the dollar after Trump met U.S. Federal Reserve Chairman Jerome Powell on Monday amid the U.S. president’s repeated criticism that the Fed has not lowered interest rates enough. In a statement, the Fed said Powell’s expectations for future policy were not discussed, but Trump has for more than a year said the Fed was undermining his economic policies by keeping interest rates too high.

Looking ahead, it’s a relatively busy day on the economic calendar. Economic data out of the U.S include October building permits and housing starts. We can expect the Dollar to find some direction from the numbers, though much will depend on trade chatter from the U.S.